Pricing

Settings - Your web shop offers a great deal of flexibility when choosing how to price products. You can choose to use a system of price rules or import prices from an excel spreadsheet. If you wish to hide carton, pack, or single prices on your web shop you can do so here.

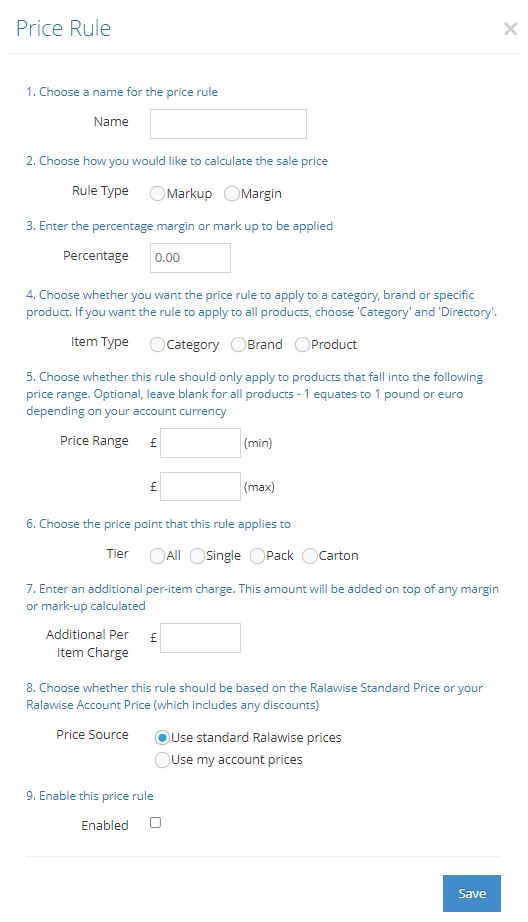

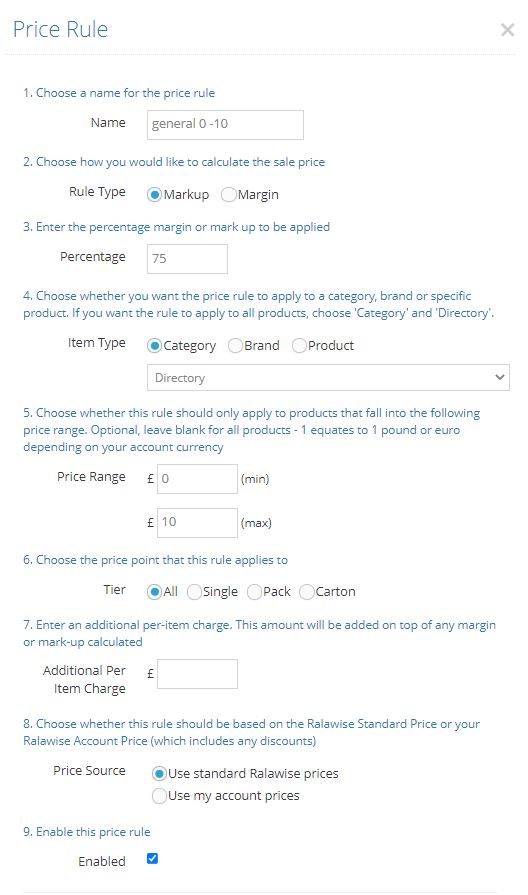

Price Rules - Simply click ‘Add’ to create a new price rule. You will now be presented with a pop window that allows you to configure the price rule. Once you are finished creating/editing your price rule, tick the ‘enabled’ check box and click ‘Save’.

Price rules are evaluated based on the order they appear in the list i.e. price rules at the top of the list are applied to products first. If the price rule is not applicable, the next price rule is applied. You can reorder the price rules by clicking on the move icon and dragging it to your desired position in the list. The following example explains this logic further.

Price Rule Description

A 20% margin on products priced between £50 and £100

B 30% mark-up on category Jackets using Ralawise standard price

C 50% margin on all products using my account price

Other points to note:

• More specific price rules such as Price Rule A should appear at the top of the list

• More general price rules such as Price Rule C should appear bottom of the list

• Remember to name the price rule as per the examples above. This will allow you to organise your pricing rules more effectively.

A common method for pricing products is by price range. You are likely for example to charge a different margin/markup on a t-shirt vs a technical jacket. The screenshot below shows how to set up prices rules based on a product's price range.

VAT Set Up - There are several options for displaying VAT on your web shop. If you choose to display prices ex VAT, VAT will be added to the cart subtotal. If you choose to not display prices ex VAT, prices will include VAT at the specified percentage.

When VAT is switched on, YourWebShop will default to applying VAT to those items that are VATable in the UK. Should you wish to choose which products have VAT applied, you can do so by switch ‘Apply VAT per Product’ to ON. You can then set the VAT status per product in Catalogue -> Products.

If you would like to trade in regions where the tax on sales may be known by another name (e.g. in Sweden, VAT is called MOMS), you can change the name displayed by using the ‘VAT Label’ setting.

VAT on delivery is configured separately. You can choose to include or exclude VAT from a delivery charge by accessing the relevant rule and configuring the option ‘Delivery Charge is ex-VAT’.

The customer will see a VAT summary on the order confirmation page and order confirmation email. This is essentially a breakdown of how VAT has been charged on an order, taking into account the order subtotal and delivery charge.

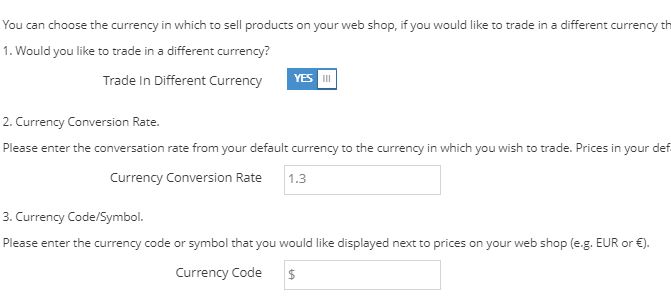

Currency Setup

You have the option to apply a conversation rate to the prices displayed on YourWebShop to enable you to display prices in a different currency. For example to trade in USD you would need to switch ‘Trade In Different Currency’ to ON, specifying a Currency Conversion Rate of 1.3 and entering a Currency Code of USD results in: